|

|

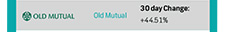

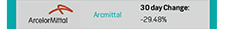

| The JSE continues to show its resilience to the world’s economic woes although it’s still susceptible to the high levels of world market volatility. We have continued to see quick successive drops and recoveries over the past few months but still sit at levels just off the 42016 point record high. Many of our Dollar hedged shares have benefited from the weaker Rand which includes most of our resource companies who are experiencing a small amount of downside protection from the recent tumbles in most major commodities. |

|

Despite our fairly upbeat position, SA as the rest of the world is keeping their eyes on the world’s major reserve banks and their future decisions, for long term direction in the market.

|

|

|

|

|

|

* Figures based on shares available in the Share Builder basket, over the last 52 weeks, as at 23 July 2013 |

|

|

|

* Figures based on top 100 companies over the last 52 weeks, as at 23 July 2013 |

|

|

|

|

|

|

|

By Yusuf Wadee

Long term investing is very much like a marathon – “don’t burn yourself out son or you won’t last distance” is the phrase that comes to mind. For many investors the thought of investing in the stock market is terrifying – “I heard that the Chinese economy is slowing down?”, “The news reported that JSE fell 3 % today!”. This constant bombardment of noise acts relentlessly to torture investors who follow the market’s every ebb and flow. Very soon the strenuousness of it all ensures that the poor investor cashes up, never to invest again... until the next wave of positive news. “I heard US markets are hitting an all-time high!”, “A friend of mine mentioned that his share portfolio is up 26% this year”. This knee jerk reaction to every piece of market noise is what long term investors have to block out - very much like a marathon runner who sticks to his race strategy, set out long before the race has even started.

But let’s take a step back. If you consider the rationale of why you invest in the first place the answer is quite straightforward: you invest in markets to increase your wealth over time. The cornerstone of this expectation of enrichment stems from what market experts refer to as the risk premium. As complicated as this sounds, risk premium describes a rather basic idea - because markets are riskier then say, simply leaving your money safely in a bank account, by its nature they have to offer a better return on your money over the long term than the interest you receive on your bank account. Other economic motivations for being invested in stock markets have also been widely acknowledged. The ever increasing cost of living is reason enough to have exposure to the stock markets over long periods. Markets, in particular equity markets, have proven to offer decent protection against inflation with investment returns in equity markets outperforming inflation historically.

An important dynamic that you have to consider when investing over the long term is how then to deal with market swings. Timing the market can be a futile and exhaustive exercise. It is here where a simple but effective technique called rand cost averaging can be used. This is a technique the benefits of which are not immediately apparent. Rand cost averaging refers to the constant and regular investments made into markets over a long period of time – Much the same as what is achieved by say scheduling a debit order to invest at the end of every month. What this achieves is that as market prices fluctuate, these seemingly simple regular monthly investments take on quite a smart dynamic. When markets go up and are expensive, these smaller regular investments are not able to purchase as much of the market. You therefore end up purchasing less of the ‘expensive’ market. When markets come down or are slightly cheaper, these investments are able to buy a lot more. Thus purchasing much more of the ‘cheaper’ market. This is what is referred to as rand cost averaging and it serves to ensure a smooth ride when investing over the long term.

As for the long term investor one thing is certain - markets will go through periods of ups and downs. These however should all be bumps on the road, as the age old marathon adage goes – slow and steady wins the race. |

|

|

|

|

Stats show that trying to ‘time’ the market will almost always place investors in a worse position than buying and holding over the same period. |

|

|

|

You can buy and sell Krugerrands online with FNB’s Share Builder or Share Investor Accounts. We offer to keep your Krugerrands in safe storage at Rand Refinery Ltd. and guarantee to buy them back from you.

Click here to find out more or buy online.

|

|

|

|

|

|

| © Copyright 2013, First National Bank - a division of FirstRand Bank Limited. An Authorised Financial Services and Credit Provider (NCRCP20). |

| |