| |

MAY 2014 RELEASE  THIS COMMUNICATION EMANATES FROM LEE-ANNE VAN ZYL THIS COMMUNICATION EMANATES FROM LEE-ANNE VAN ZYL |

| |

THIS COMMUNICATION IS FOR INTERNAL USE ONLY |

|

We are pleased to share with you a number of enhancements to our platforms which will be available from Sunday the 18th of May 2014. |

|

| |

| |

| |

|

| |

| 1.1 FNB Insurance - Updated Business Function (Enhancement) |

| |

|

We have redesigned the business function (ZIO010F) that is used to return data for Insurance Short Term and Online Life Products, to include the sub-product information.

By requesting the sub product information only, the size of the data being passed onto the business function will be reduced which will eliminate the issues being experienced due to the size of the data currently being returned, thereby improving the overall efficiencies of this business function. |

| |

This is for:

This functionality will be available to the Primary User of a Consumer profile who has existing Insurance products with FNB Insurance.

Benefiting Segment:

- Consumer Segment (Insurance)

|

Find it here:

Available to:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

| 1.2 Travel Order History Status (Enhancement) |

| |

|

We have introduced two new statuses for our Travel Orders (Purchase Foreign Currency as either cash or traveller's cheques) on Online Banking which will assist our clients to identify the status of all their Travel orders more accurately.

The available statuses for Travel Orders on Online Banking:

- Outstanding Application

- Pending Application

- Waiting delivery

- Awaiting delivery / collection (new)

- Completed (new)

|

| |

This is for:

This functionality will be available to all clients on Online Banking.

Benefiting Segments:

- Consumer Segment

- Business Segment (Forex): Primary Sponsoring Segment

- Premium Segment

|

Find it here:

- Forex > Travel > Forex Order History

Available to:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

| 1.3 Enabling Financials on Renminbi Accounts (Enhancement) |

| |

|

In October 2013 we included the Renminbi (CNY) as a new foreign currency offer with the ability to perform non financial functionality such as viewing account balances, transaction history, detailed balance enquiry, email statements and statement history on all Renminbi Global Accounts via Online Banking.

Renminbi (CNY) is the official currency of the People's Republic of China.

We are now enabling the ability to perform financial transactions on Renminbi Global Accounts and giving clients the ability to perform the following financial transactions using their Renminbi Global Account via Online Banking:

- Transfers 'from' and 'to' Renminbi Global Accounts

- Forex Outward Payments from Renminbi Global Accounts

- Forex Inward Payments into Renminbi Global Accounts

All Global Payments, Receipts and Transfers 'from' and 'to' Renminbi Global Accounts can be facilitated from a GB Pound, Euro, US Dollar and South African Rand Account. The Australian Dollar and Indian Rupee are excluded for now but will be added at a later stage.

Furthermore, we will also replace the currency code 'CNY' with the currency symbol on the My Bank Accounts page.

Currency Code |

Currency Symbol |

| |

|

CNY |

|

|

| |

This is for:

This functionality will be available to the Primary User of a Consumer profile who has one of the following Renminbi Global Account linked to their Online Banking profile:

- DDA 58 (CBS)

- DDA 5Y (Wealth)

Benefiting Segments:

- Consumer Segment (VBS) – Primary Sponsoring Segment

- Premium Segment (Forex & Transactional)

|

Find it here:

- Transfer Tab > Transfers between Global Accounts

- Forex – Outward and Inward payments

- My Bank Accounts Tab > Display the Currency Symbol

Available to:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

|

| |

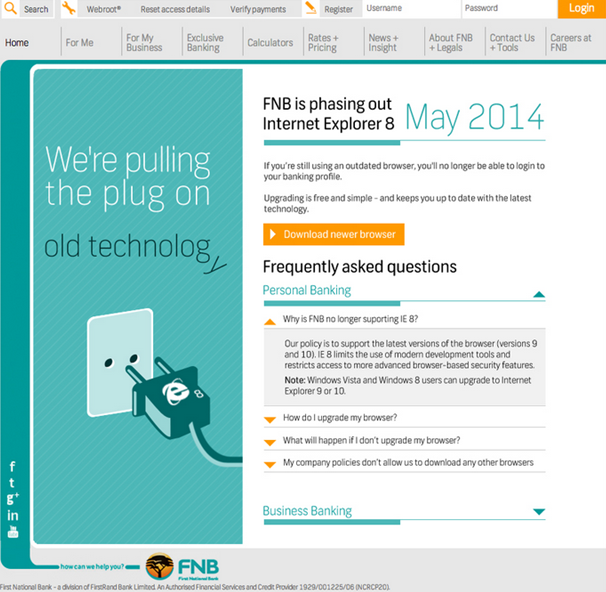

| 2.1 IE8 Exit (New) |

| |

|

After providing support for Windows XP for the past 12 years, Microsoft has announced that they are discontinuing their support, technical assistance and security updates for Windows XP as from the 8th April 2014. This means that clients will still be able to use Windows XP but will be at risk and more vulnerable to security risks and viruses.

As more software and hardware manufacturers continue to optimize for the newer versions of Windows, clients can also be expected to encounter issues with regards to other apps and devices no longer working and/or not getting support for these on Windows XP computers.

This includes the phasing out of Internet Explorer 8, the primary Browser for Windows XP. Our policy is to support the latest browser versions as it contains the latest feature updates, vulnerability fixes and performance improvements to previous versions.

To communicate effectively and minimise any impacts on our clients currently using the older and unsupported browser version, we will be phasing out the use of IE 8 in the following three stages:

| Stage |

Description of Stage Activity |

Planned Live Date |

| Stage 1 |

We will display a Notification of the phasing out of IE 8 via Banners and Campaign pages on the FNB and FRB Homepage.

The Software Downloads page will be updated.

(Excludes RMB) |

First Week in June 2014 |

An overlay providing Notification of the phasing out of IE8 will be displayed to all IE8 users when trying to login.

(Includes all Skins and Countries)

We will also display a Notification of the phasing out of IE 8 once the client logs into their Online banking Enterprise™ profile.

(Includes RMB) |

Second week in July 2014 |

| Stage 2 |

Login fields will not be available on the FNB Home page and clients will need to Download a supported Browser version. Once the client has upgraded their IE browser version, they will be able to login as per normal.

(Includes all Skins and Countries) |

Second week in August 2014 |

| Stage 3 |

Access to the FNB home page will be prevented and clients will need to Download a supported Browser version. Once the client has upgraded their IE browser version, they will be able to access the FNB Home page as per normal.

(Includes all Skins and Countries) |

Second Week in September 2014 |

|

| |

The actual live dates for each phase will be communicated closer to the time of implementing the relevant phases. |

| |

This is for:

Online Banking and Online Banking Enterprise™:

These Notifications will be displayed to all Online Banking and Online Banking Enterprise™ clients.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Online Banking and Online Banking Enterprise™:

Available to:

Online Banking and Online Banking Enterprise™:

- South Africa: FNB and RMB Private Bank

- African Subsidiaries: Namibia, Botswana, Lesotho, Swaziland, Zambia and Tanzania

- First Rand Bank: India

|

|

| |

Stage 1 - The Notification displaying on the Campaign page via the FNB Home Page: |

| |

|

| |

| |

Stage 1 - The Notification displaying on the IE 8 Exit Overlay via the FNB Home Page: |

| |

|

| |

| |

| Back to index |

| |

| 2.2 Pricing Letters and Pricing Guide 2014 - 2015 (New) |

| |

|

The annual FNB price increase takes effect on the 1st of July each year. This increase is applied across various FNB products and services for both Consumer and Commercial clients.

Pricing Letters and Pricing Guides will be available to all clients registered on Online Banking and individual clients registered on Online Banking Enterprise™ from the 1st of June and will be effective for the July billing month.

Pricing letters will be available online for download for all clients that hold personal Cheque Accounts with FNB, certain Transmission Accounts, certain RMB Private Bank Accounts, FNB Private Clients and Wesbank Credit Cards as well as small Business Accounts.

When the client selects the relevant Pricing download link, the system will open a PDF file for download. |

| |

This is for:

Online Banking and Online Banking Enterprise™:

The Annual Price Increase is applied across various FNB products and services.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Online Banking and Online Banking Enterprise™:

- News Tab > More Options Menu > Price Review Letter

Available to:

Online Banking and Online Banking Enterprise™:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

| 2.3 Wealth Rewards on eBucks and eB4B Termination (New) |

| |

|

With the growing accomplishments of eBucks, South Africa's leading multi-partner reward programme, it only makes for good business strategy to move all our other reward programmes into their world and benefit directly from the successes and expertise housed within eBucks.

This means that the various reward programmes for Retail, Wealth, as well as Business clients will now all be available via the eBucks website.

Online Banking and Online Banking Enterprise™ clients will be able to access the eBucks website via the Rewards tab where they can view all their rewards information as well as complete all their eBucks purchases from one website, eBucks.com.

|

| |

This is for:

Online Banking:

This functionality will be available to any individual or business client who has any of the following FNB or RMB products linked to their Online Banking profile:

- Cheque Account

- Credit Card

- Single Facility

- Business Account

Online Banking Enterprise™:

This functionality will be available to any business client who has a business eBucks account linked to their Online Banking Enterprise™ profile.

Benefiting Segments:

- Consumer Segment

- Business Segment: Primary Sponsoring Segment

- Premium Segment

|

Find it here:

Online Banking and Online Banking Enterprise™:

Available to:

Online Banking and Online Banking Enterprise™:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

| 2.4 Completion of Forex Outward Payment (Enhancement) |

| |

Online Banking and Online Banking Enterprise™ clients can now view and complete all their Outward Payments online even if they have been initiated from another banking channel including via the Branch or the Forex Advisory Team.

This means that going forward, all forex outward transactions will automatically be routed to the respective Online platform.

Clients will receive a notification informing them that an Outward SWIFT application has been routed to their Online Banking or Online Banking Enterprise™ profile which will allow them to complete the Forex transaction at their leisure by allowing them the opportunity to save a Forex Payment and complete it at a later stage. |

| |

|

|

This is for:

Online Banking:

Forex functionality is restricted to the Primary User of a Consumer and/or Business profile.

Online Banking Enterprise™:

The Forex functionality is available to all users who has been granted the relevant transact permissions by the Administrator(s).

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment: Primary Sponsoring Segment

|

Find it here:

Online Banking and Online Banking Enterprise™:

- Forex Tab > Global Payments > Forex Payment

Available to:

Online Banking and Online Banking Enterprise™:

|

|

| |

| Back to index |

| |

| 2.5 Online Secure (Enhancement) |

| |

Our Verified by Visa (VbyV) functionality is being rebranded to Online Secure. This change is necessary in order for us to prepare for issuing of Master Cards and using MasterCard SecureCode which will be rolled out later this year.

Online Secure is a three factor authentication service mandated by either Visa (through Verified by Visa (VbyV)) or MasterCard (through SecureCode) which uses a One Time PIN (OTP) or personal password to protect a cardholder against unauthorised use of their card when making online purchases.

Once Online Secure has been activated, the Visa or Master Card number cannot be used for online purchases without a One Time PIN (OTP) or personal password.

Online Secure aims to reduce the number of fraudulent online shopping transactions processed to cardholders accounts. |

| |

|

|

This is for:

Online Banking and Online Banking Enterprise™:

This functionality is available to all users on Online Banking and Online Banking Enterprise™.

Benefiting Segments:

- Consumer Segment (VBS): Primary Sponsoring Segment

- Business Segment

- Premium Segment

|

Find it here:

Online Banking:

- My Bank Accounts Tab > My Cards Sub Tab

- My Bank Accounts > Account Settings > Cards Sub Tab

Online Banking Enterprise™:

- My Bank Accounts Tab > Account hyperlink > Cards Sub Tab

Available to:

Online Banking and Online Banking Enterprise™:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

|

| |

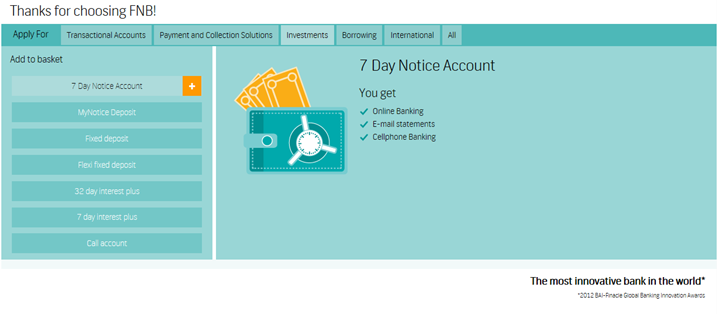

| 3.1 Savings & Investment - Business Segment Clients (New) |

| |

With the growing popularity towards self-service and DIY banking where the client can perform many functions Online or through a mobile channel it is evident that it is necessary that we increase our products and service offerings on the Online Sales platform.

This will enable FNB Business clients to open the following Savings and Investment accounts online via the Online Sales platform:

- MyNotice Deposit - Business; Commercial

- 7 Day Notice Deposit - Business; Commercial

- Flexi Fixed Deposit – Business only

|

|

| |

| Mynotice Deposit |

| |

- The minimum opening deposit is R1000.00

- Access up to 100% of your money, with 45 days, notice at no cost

- Access up to 100% of your money, with 1 - 44 days notice, at a cost

- Multiple notices allowed

- Ability to add money anytime

- Third party payments allowed (based on availability of funds)

|

| |

| 7 Day Notice Deposit |

| |

- The minimum opening deposit is R50 000.00

- Two interest rate increases apply: once after 32 days and again after 64 days of opening the account

- Capital funds may deposited or withdrawn (7 days' notice is required for withdrawals)

|

| |

Flexi Fixed Deposit |

| |

- The minimum opening deposit is R100.00

- The flexibility of being able to deposit any amount into your account at any time

- Choose between a 3 and 12 month deposit term

- The ability to make 2 withdrawals of 15% each on the available balance during your investment term

- An interest rate linked to the prime lending rate

|

| |

This is for:

This functionality will be available to all Business and Commercial clients.

Benefiting Segments:

|

Find it here:

Available to:

|

|

| |

| |

FNB Business Segment clients will now be able to open the following Savings and Investment accounts online via the Online Sales platform:

|

|

| |

| |

| Back to index |

| |

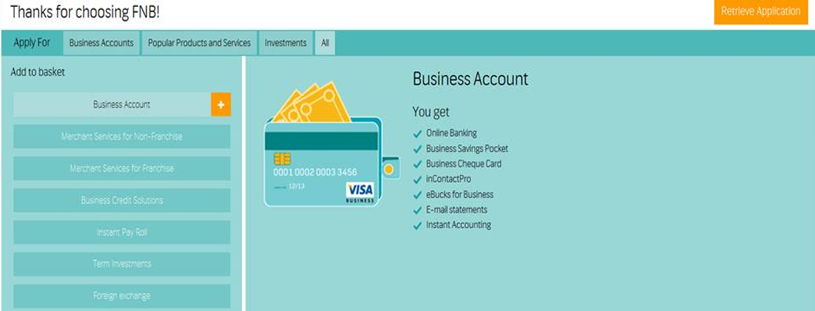

| 3.2 Business Segment SSA - Credit Merchants and Online-Contracting (New) |

| |

In line with increasing the available products and service offerings for Business Segment clients via the Online Sales platform, we have introduced the following real time account applications via SSA:

|

|

| |

| Merchant Services: |

| |

Existing Business Segment clients can apply for a New Merchant Account or an additional Merchant Services device on an Existing Merchant Account online via SSA.

Should the client request to take-up the offer, they will be prompted to complete the application. If the application is successful (scored through the Commercial Application Database (CAD)), the client may accept credit agreements for certain products and prices (electronic contracting). |

| |

| Business Credit Solutions: |

| |

| Existing Business Segment clients can now apply for new or increased credit facilities online via SSA.

.Should the client request to take-up this offer, they will be prompted to complete the application. If the application is successful (scored through the Commercial Application Database (CAD)), the client may accept credit agreements for certain products and limits which include Credit Card, Overdraft and Business Loans. |

| |

| Online Contracting: |

| |

| This functionality will enable clients the ability to complete their credit contracts on Online Banking. |

| |

This is for:

This functionality is available to all Business and Commercial clients.

Benefiting Segments:

|

Find it here:

- https://www.fnb.co.za > For my Business > Credit

https://www.fnb.co.za > For my Business > Merchant Services

- https://www.fnb.co.za > Do it now > For My Business > Business Banking < 10m annual turnover > Merchant Services for Non - Franchise

- https://www.fnb.co.za > Do it now > For My Business > Commercial Banking > 10m annual turnover > Merchant Services for Non – Franchise

- https://www.fnb.co.za > Do it now > For My Business > Business Banking < 10m annual turnover > Merchant Services for Franchise

- https://www.fnb.co.za > Do it now > For My Business > Commercial Banking > 10m annual turnover > Merchant Services for Franchise

- https://www.fnb.co.za > Do it now > For My Business > Business Banking < 10m annual turnover > Business Credit Solutions

- https://www.fnb.co.za > Do it now > For My Business > Commercial Banking > 10m annual turnover > Business Credit Solutions

Available to:

|

|

| |

Business Segment clients can now apply for new or increased credit facilities and/or Merchant Services online via SSA: |

| |

|

| |

| |

| Back to index |

| |

| 3.3 Big 3 Business Segment SIC Codes Shells (Enhancement) |

| |

|

Big 3 was created to increase take-up in selected product offerings by marketing products, services and value adds to existing qualifying clients inside of login.

Each product offer is displayed as an icon with a short message on the My Bank Accounts tab. Clicking on the icon will enable the client to learn more about the product offering and, where possible, to be redirected to the respective functionality inside of login, or alternatively, the client will be redirected to an application form via SSA. |

| |

| The following new Big 3 maintenance offers have been added: |

| |

| Business Banking SIC Code Maintenance Shell |

| |

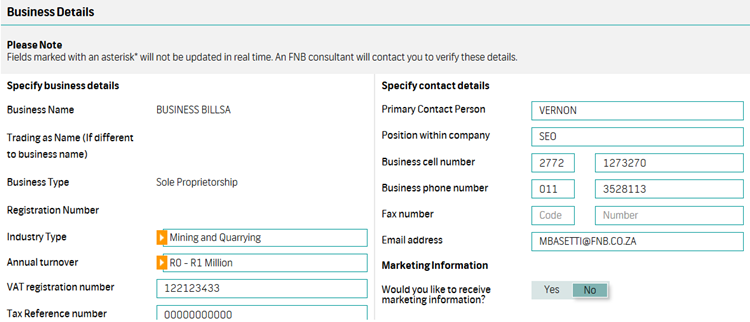

The SIC Code Maintenance offer will be displayed to all BusinessSegment customers (type 02, 03, 04, 05, 06, 07, 08, 10 11, 13, 18 and 19) allowing them to update their Business SIC codes.

SIC Codes, or Standard Industrial Classification codes, are an internationally accepted set of codes for the standard classification of all economic activities. These codes are prescribed by the Department of International Economic and Social Affairs of the United Nations.

This offer gives our clients convenient access to easily update their business classification which will lead to an overall improved and more accurate classification and reporting statistics to SARB.

Once the client selects this offer, they will be redirected to the Business Details Maintenance page inside of login where they will be able to update their business details including the industry type (SIC code) as required. |

| |

| |

This is for:

The Business Banking SIC Code Maintenance offer will be available to all qualifying Business Segment clients on Online Banking.

Benefiting Segments:

|

Find it here:

Available to:

|

|

| |

| |

The Business Details Maintenance Page: |

|

| |

| Back to index |

| |

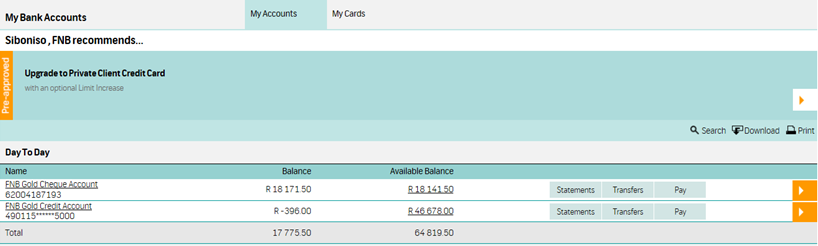

| 3.4 Big 3 changes - Inclusion of PRVT in Pre-Approved Card Offers (Enhancement) |

| |

|

Clients who qualify for Pre-approved Credit Card upgrade and/or limit increase will now have the ability to upgrade to a Private Client credit card. |

| |

| The following enhancements to the existing Big 3 Pre-Approved Card offer: |

| |

- The offer has been renamed to “Private Clients Credit Card”

- We have included the card image on the offer

- We have provided a link to the correct Private Clients pricing guide

|

| |

This is for:

The Private Client Credit Card offer (ZFN 81) will be available to qualifying individual customers on Online Banking.

Benefiting Segments:

|

Find it here:

Available to:

|

|

| |

The Pre-approved Private Client Credit Card offer:

|

|

| |

| Back to index |

| |

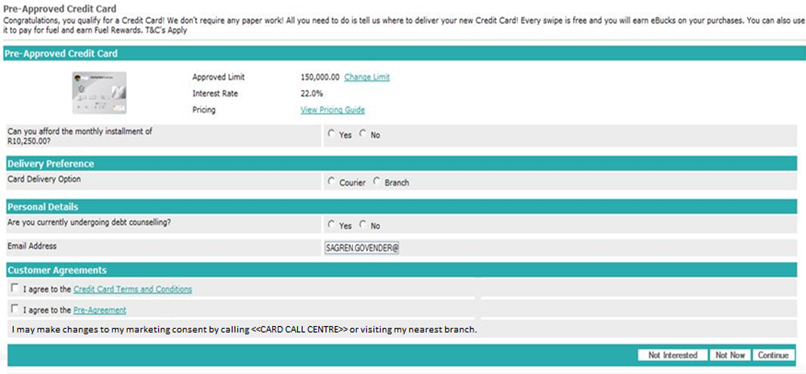

| 3.5 Big 3 - Pre-Approved Credit Card Marketing (Enhancement) |

| |

|

According to NCA regulation, a client must be able to provide marketing consent when entering into a new credit agreement.

Our Big 3 Pre-approved Credit Card offer is currently the only offer which does not allow clients who wish to "opt out" of direct marketing to select this option.

We have added the following clause to all our CCNC offers just below the I agree to the Pre-Agreement checkbox: “I may make changes to my marketing consent by calling <CARD CALL CENTRE> or visiting my nearest branch.”

This change will ensure that we are compliant with the NCA rules and regulations applicable to electronic marketing. |

| |

This is for:

This functionality will be available to all Consumer clients applying for any of the following FNB products via the BIG 3 offers on Online Banking:

- ZFN 15 – FNB Gold Credit Card

- ZFN 7 – FNB Classic Credit Card

- ZFN 36 – FNB Platinum Credit Card

- ZFN 81 – FNB Private Clients Credit Card

Benefiting Segments:

|

Find it here:

Available to:

|

|

| |

A new clause

has been added to all Big 3 Pre-approved Credit Card offers:

|

|

| |

| |

| Back to index |

| |

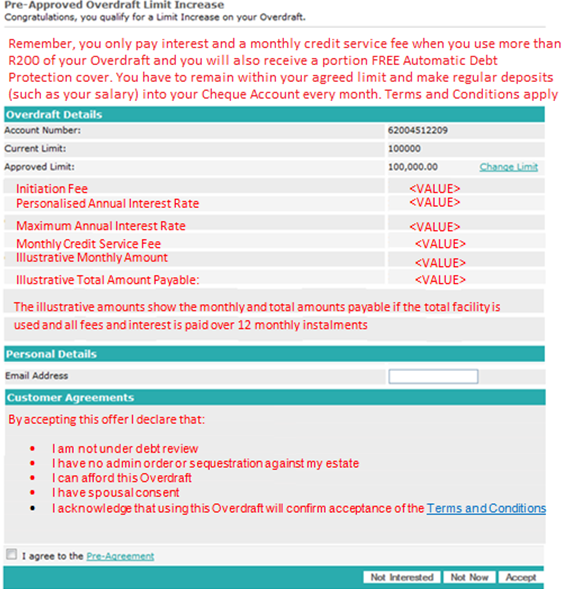

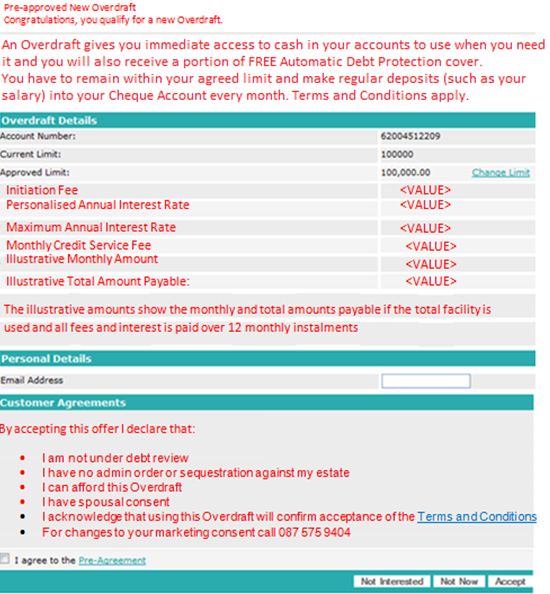

| 3.6 Big 3 - Overdraft - Compliance Screen Changes (Enhancement) |

| |

|

The Big 3 Pre-approved Cheque Overdraft (CANL/CALI) offers were switched off due to compliance related issues.

To conform to the required regulatory rules, we have included some additional text and field changes to the Pre-approved Cheque Overdraft offers which means we can display them again to all individual clients who qualifies for a Pre-approved Overdraft or Overdraft Limit increase.

Once the client has completed the application, it will be submitted to the fulfilment centre who will then process the request. |

| |

This is for:

This functionality will be available to Consumer clients applying for any of the following FNB products via the BIG 3 offers on Online Banking:

- Overdraft Limit Increase

- New Overdraft

- All Overdraft Qualifying DDA accounts

Benefiting Segments:

|

Find it here:

Available to:

|

|

| |

The following

field and text changes has been made to the Overdraft Limit increase offer: |

| |

|

| |

The following

field and text changes has been made to the new Overdraft offer: |

|

| |

| Back to index |

| |

| |

|

| |

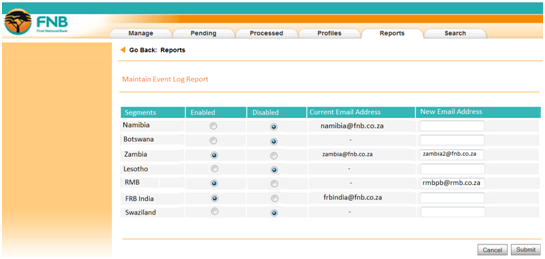

| 4.1 OASSYS - Daily Audit Trail (New) |

| |

Currently the event log reports are being extracted manually by an administrator on a weekly basis and forwarded onto the various segments that request these reports.

It is a vital business function to monitor all maintenance done on a clients business and/or individual profiles and this needs to be monitored on a daily basis to prevent potential risk/fraud for the bank and for our clients.

To ensure that we are able to do this, we have introduced a new Event Log maintenance function which will allow an administrator to setup an email address for a specific segment to receive the Event Log reports. Once created by the administrator, the report will automatically be emailed to the segments on a daily basis.

Therefore should a segment wish to receive these event log reports on a daily basis via email, they need to contact their OASSYS Administrator to setup the relevant details. |

| |

|

This is for:

This functionality is limited to the Administrators on OASSYS.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Available to:

- South Africa: FNB and RMB

- African Subsidiaries: Namibia, Botswana, Lesotho, Swaziland, Zambia and Tanzania

- First Rand Bank: India

|

|

| |

|

OASSYS Administrators can now set up and maintain the details for other Segments to receive daily Event Log Reports via email: |

| |

|

| |

| Back to index |

| |

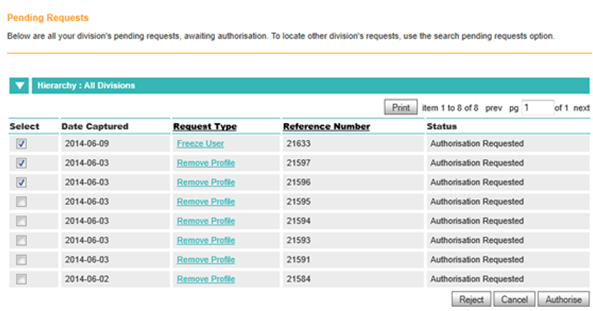

| 4.2 OASSYS - Bulk Authorisation (New) |

| |

A further improvement to the Authorisation process on OASSYS is that authorisers will now have the ability to execute multiple authorisations at the same time from the Pending tab instead of authorising each instruction individually. |

| |

|

This is for:

This functionality is available to internal OASSYS users who have been granted the necessary permissions.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- Pending tab>Hierarchy/Profile

- Pending Tab>Search Pending Requests

Available to:

- South Africa: FNB and RMB

- African Subsidiaries: Namibia, Botswana, Lesotho, Swaziland, Zambia and Tanzania

- First Rand Bank: India

|

|

| |

OASSYS Authorisers can now perform multiple authorisations at the same time:

|

|

| |

| Back to index |

| |

| |

| |

| |

© Copyright 2014, First National Bank - a division of FirstRand Bank Limited. An Authorised Financial Services and Credit Provider (NCRCP20).

FNB will never ask you to login to online banking via a link in an email.

|