| |

JUNE 2014 RELEASE  THIS COMMUNICATION EMANATES FROM LEE-ANNE VAN ZYL THIS COMMUNICATION EMANATES FROM LEE-ANNE VAN ZYL |

| |

THIS COMMUNICATION IS FOR INTERNAL USE ONLY |

|

We are pleased to share with you a number of enhancements to our platforms which will be available from Sunday the 15th of June 2014. |

INDEX |

|

|

| What is being Released |

Segments Benefitting |

Countries and Skins |

| Online Banking |

| 1.1 Account Settings Dashboard |

Consumer

Business

Premium |

South Africa: FNB, RMB Private Bank and Discovery

Joint Ventures: Clicks and kulula |

| 1.2 Contact Us - Post Login |

Consumer

Business

Premium |

South Africa: FNB |

| 1.3 Registrations |

Consumer

Business

Premium |

South Africa: FNB, RMB Private Bank and Discovery

African Subsidiaries: Namibia, Botswana, Lesotho, Swaziland, Zambia and Tanzania

First Rand Bank: India

Joint Ventures: Clicks and kulula |

| 1.4 Balance Transfer |

Consumer

Business

Premium |

South Africa: FNB, RMB Private Bank and Discovery

African Subsidiaries: Namibia and Botswana

Joint Ventures: Clicks and kulula |

| 1.5 FNB Insurance - New Short Term Sub Products |

Consumer

Business

Premium |

South Africa: FNB and RMB Private Bank |

| 1.6 Big 3 - Home Loans Lead Shell |

Consumer

Business

Premium |

South Africa: FNB |

| Online Banking and Online Banking Enterprise™ |

| 2.1 Annual Price Increase - South Africa |

Consumer

Business

Premium |

South Africa: FNB and RMB Private Bank |

| 2.2 Testing for New RTC Participant Bank - SASFIN |

Consumer

Business

Premium |

South Africa: FNB and RMB Private Bank |

| 2.3 FACTA |

Consumer

Business

Premium |

South Africa: FNB and RMB Private Bank |

| 2.4 Frontend Framework |

Consumer

Business

Premium |

South Africa: FNB, RMB and RAS

African Subs: Botswana, Lesotho, Namibia, Swaziland, Tanzania and Zambia

FirstRand Bank: India |

| 2.5 IE8 Exit |

Consumer

Business

Premium |

South Africa: FNB, RMB Private Bank and Discovery

African Subsidiaries: Namibia, Botswana, Lesotho, Swaziland, Zambia and Tanzania

First Rand Bank: India

Joint Ventures: Clicks and kulula |

| Sales |

| 3.1 SSA Wealth |

Consumer

Business

Premium |

South Africa: RMB Private Bank |

| 3.2 DDA 93 - Rationalisation |

Consumer

Business

Premium |

South Africa: FNB |

| 3.3 Spousal Consent |

Consumer

Business

Premium |

South Africa: FNB |

| 3.4 FACTA |

Consumer

Business

Premium |

South Africa: FNB |

| Web |

| 4.1 Home Loan Bond Calculator |

Consumer

Business

Premium |

South Africa: FNB |

| Online Banking Internal Support Enhancements and Efficiencies |

| 5.1 SDK Upgrade for PayPal |

Consumer

Business

Premium |

South Africa: FNB |

| 5.2 Batch Archiving |

Consumer

Business

Premium |

South Africa: FNB and RMB

African Subsidiaries: Namibia, Botswana, Lesotho, Swaziland, Zambia and Tanzania

First Rand Bank: India |

| 5.3 Product Rule Changes |

Consumer

Business

Premium |

South Africa: FNB and RMB

First Rand Bank: India |

|

| |

|

| |

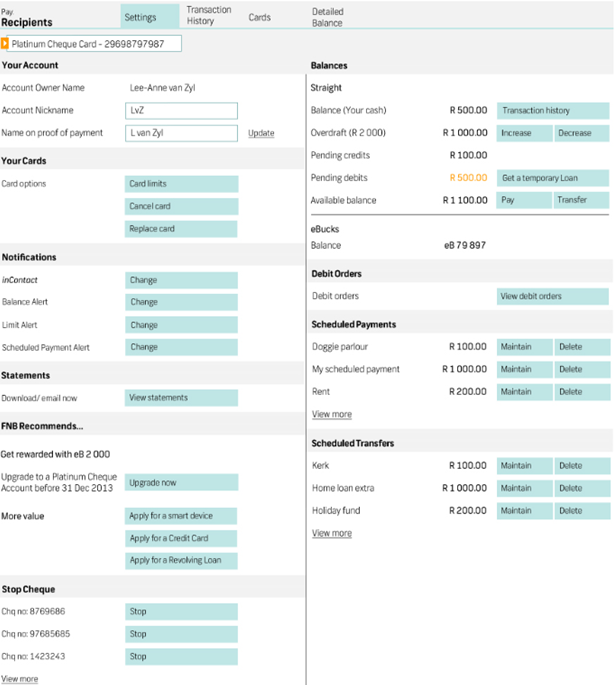

| 1.1 Account Settings Dashboard (Enhancement) |

| |

|

The new Account Settings dashboard will provide our clients with quick and easy access to the most commonly used banking functionalities per account type available within a single page.

Clients with qualifying cheque and credit card accounts will be able to access the following functionality, grouped together for the respective account types, on the Account Settings Dashboard: |

| |

| The Cheque Account Dashboard functionality: |

| |

- View Account Owner Name/Change Nickname

- View Statements

- Stop Cheque

- Redirect to Scheduled Payments and Transfers

- Card options

- Balances

|

| |

| |

| The New Cheque Account Setting Dashboard Page:

|

| |

|

| |

| |

| |

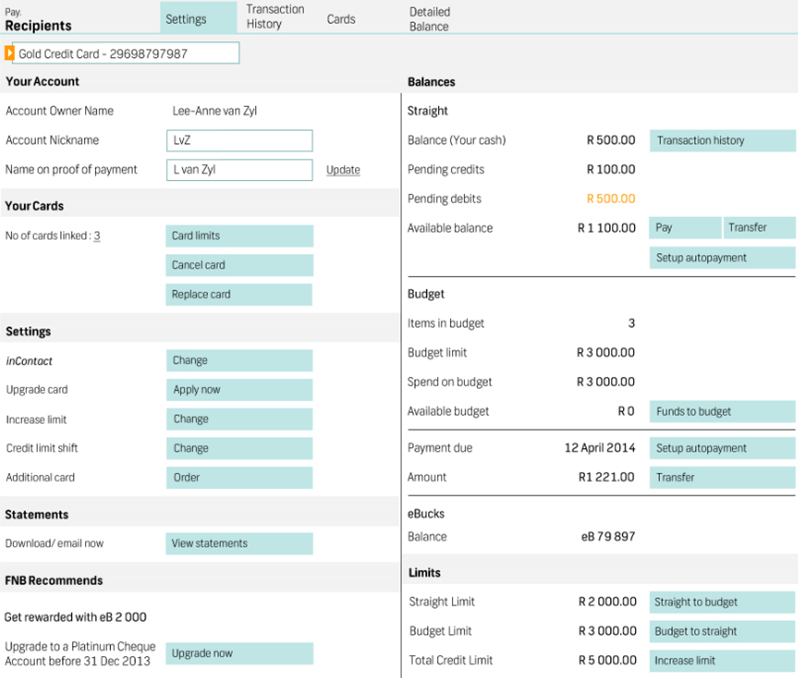

| The Credit Card Dashboard functionality: |

| |

- View Account Owner Name/Change Nickname

- View Statements

- Balances

- Limits

- Card options

|

| |

| |

The New Credit Card Account Settings Dashboard Page: |

| |

|

| |

| |

This is for:

This functionality will be available to the Primary User of a Consumer profile who has a qualifying Cheque and/or Credit Card account linked to their Online Banking profile.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- My Bank Account tab > Menu > Accounts Settings

- My Bank Account tab > Select an applicable Account > Accounts Settings

Available to:

- South Africa: FNB, RMB Private Bank and Discovery

- Joint Ventures: Clicks and kulula

|

|

| |

| Back to index |

| |

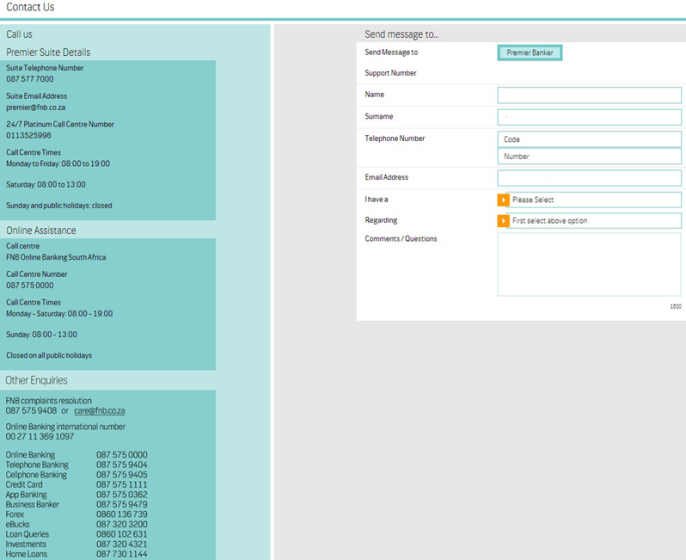

| 1.2 Contact Us - Post Login (Enhancement) |

| |

|

In an effort to reduce the time spent by Online Assistance to reroute calls which do not apply to their area of expertise, we have included a set of generic contact numbers related to specific business areas, on the 'Contact Us' landing page via Online Banking.

By including these generic contact numbers for the various business areas, this will lead to:

- an overall improvement to the rate of calls currently being received by Online Assistance

- allow Online Assistant agents to be more Online Banking focused and

- will furthermore improve the overall client experience as they will be able to quickly access the following contact numbers from a convenient central location within Online Banking:

|

| |

This is for:

This functionality will be available to the Primary User of a Consumer profile on Online Banking.

Benefiting Segment:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- Login > Contact Us (page header)

Available to:

|

|

| |

| |

| The New 'Contact Us' page will include a set of generic contact numbers to specific business areas: |

| |

|

| |

| |

| |

| Back to index |

| |

| 1.3 Online Banking Registrations (Enhancement) |

| |

|

We have made the following enhancements to improve our Online Banking Registration process:

- Personal and Business Registration users can edit and correct any incorrect details that they have captured on the registration capture page.

- We have increased the email address capture field to cater for longer email addresses for both Personal and Business Registrations.

- We have made various text changes to improve the overall flow of the Online Banking Registration process and how clients need to verify themselves after registering on Online banking.

|

| |

This is for:

This functionality will be available to the Primary User registering for a Consumer or Business profile on Online Banking.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Available to:

- South Africa: FNB, RMB Private Bank and Discovery

- African Subsidiaries: Namibia, Botswana, Lesotho, Swaziland, Zambia and Tanzania

- First Rand Bank: India

- Joint Ventures: Clicks and kulula

|

|

| |

| Back to index |

| |

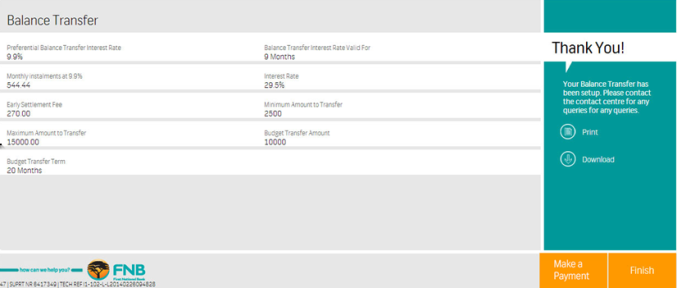

| 1.4 Balance Transfer (Enhancement) |

| |

|

We have enhanced our Balance Transfer functionality on Online Banking by including a new 'Make a Payment' button right next to the 'Finish' button on the Balance Transfer Results page.

Selecting this button will allow our clients to easily and conveniently access the pay functionality in order for them to perform a third party payment once they have completed performing balance transfer. |

| |

This is for:

This functionality will be available to the Primary User of a Consumer profile who has a qualifying Credit card Account linked to their Online Banking profile:

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- Balance Transfer Results page > Make a Payment

Available to:

- South Africa: FNB, RMB Private Bank and Discovery

- African Subsidiaries: Namibia and Botswana

- Joint Ventures: Clicks and kulula

|

|

| |

| |

| The new 'Make a Payment' button added right next to the Finish' button on the Balance Transfer Results page: |

| |

|

| |

| |

| |

| Back to index |

| |

| 1.5 FNB Insurance - New Short Term Sub Products (Enhancement) |

| |

|

We have introduced the following new Short Term Insurance sub products:

- FNB Hollard Gold Policy (ZFL HG)

- FNB Vehicle Finance Policy (ZFL FV)

- FNB First Scheme Policy (ZFL FS)

- FNB M & F Gold Policy (ZFL MG)

- FNB Saver Policy (ZFL TV)

- FNB Classic Policy (ZFL TG)

Existing clients of Short Term Insurance products will be able to view their policy details via the Home, Car and Valuables sub tab on Online Banking.

Online Banking clients who do not have any Short Term Insurance products will be presented with a marketing page on the Home, Car and Valuables sub tab with the ability to select a “Get a Quote” button.

When the client selects the “Get a Quote” button, they will be presented with a request to complete and submit their contact details. Once the client completes and submits the required information, a FNB Lead Request will be sent to FNB Insurance. |

| |

This is for:

The functionality to view the policy details will be limited to the Primary user of a Consumer profile who has existing Short Term Insurance products with FNB Insurance.

The functionality to view the Marketing page will be limited to the Primary User of a Consumer Profile and will only be displayed if the client does not have any existing Short Term Insurance products with FNB Insurance.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- Insurance tab > Home, Car and Valuables

Available to:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

| 1.6 Big 3 - Home Loans Lead Shell (Enhancement) |

| |

|

Big 3 was created to increase take-up in selected product offerings by marketing products, services and value adds to existing qualifying clients inside of login.

Each product offer is displayed as an icon with a short message on the My Bank Accounts tab. Clicking on the icon will enable the client to learn more about the product offering and, where possible, to be redirected to the respective functionality inside of login, or alternatively, the client will be redirected to an application form via SSA. |

| |

| The Home Loan Lead shell has been added to the Big 3 offers: |

| |

The Home Loan Lead offer will be displayed to all individual clients (type 01 and 14) allowing them to apply for further loans or switch their Home Loans to FNB.

Upon requesting to take-up the offer, the client will be redirected to SSA to complete the application. Once the client has completed the application, it will be submitted to the FNB Home Loans Call centre who will then process the request. |

| |

This is for:

This functionality is available to the Primary User of a Consumer profile on Online Banking.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Available to:

|

|

| |

| Back to index |

| |

| |

|

| |

| 2.1 Annual Price Increase - South Africa (New) |

| |

|

The annual FNB price increase takes effect on the 1st of July each year. This increase is applied across various FNB products and services for both Consumer and Commercial clients.

Pricing Letters and Pricing Guides will be effective for the July 2014 billing month.

When the client selects the relevant Pricing download link available via the News Tab, the system will open a PDF file for download. |

| |

This is for:

The Annual Price Increase is applied across various FNB products and services.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Online Banking and Online Banking Enterprise™:

- News Tab > More Options Menu > Price Review Letter

Available to:

Online Banking and Online Banking Enterprise™:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

| 2.2 Testing for New RTC Participant Bank - SASFIN (New) |

| |

|

SASFIN Bank is scheduled to go live as a Real Time Clearing (RTC) Participant Bank. We will commence our testing with SASFIN on 15 June 2014 and once successful, our clients will be able to make RTC payments to SASFIN Accounts and visa versa.

A Real Time Clearing (RTC) transaction is paid to Recipients at Participating Banks within 60 seconds.

This enhancement will initially only impact Online Banking clients as the RTC functionality has temporarily been deactivated in Online Banking Enterprise™. |

| |

This is for:

Online Banking and Online Banking Enterprise™:

This enhancement will initially only impact Online Banking clients as the RTC functionality has temporarily been deactivated in Online Banking Enterprise™.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Online Banking:

- Pay Tab > Add payment > Pay and Clear Now Service type

Online Banking Enterprise™:

- Payments Tab > Add payment > Pay and Clear Now Service type

Available to:

Online Banking and Online Banking Enterprise™:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

| 2.3 FACTA (Enhancement) |

| |

|

The Foreign Account Tax Compliance Act (FATCA) is a United States federal law which requires that all United States persons, including individuals who live outside the United States, are required to report their financial accounts and assets held outside of the United States.

This means that all South African financial institutions are obliged to identify and report US born citizens to SARS and SARS will then report these to the IRS.

In order for us to cater for this compliance requirement, a new field has been added to our processes to correctly identify US born citizens (for individuals) and US established businesses.

The following changes have been made to Online Banking and Online Banking Enterprise™:

We have created a new 'Country of birth' field for Individuals and' Country of Establishment' field for Businesses who are applying for any of the following products via our Online Banking and/or Online Banking Enterprise™ platforms:

- Paypal

- Consultant Registration - Online Banking and/or Online Banking Enterprise™

- CUAC linking

- Related Parties Online Banking and/or Online Banking Enterprise™

- Add a new Cardholder

- Smart Payroll

As part of these compliance requirements, all US born clients will not be allowed to set up a profile on our systems for any of the African Subsidiaries and our system will block these applications and return the following error message: “Cannot setup customer”.

Should a US born client inquire as to why they are being blocked in the African subs, we will need to inform them of the compliance regulations with the Foreign Account Tax Compliance Act (FATCA). |

| |

This is for:

The new fields will be displayed on all new Account and/or Product applications made via Online Banking and Online Banking Enterprise™.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Online Banking:

- Online Banking Registrations

- Forex Tab > PayPal

- My Bank Account > Account Settings > Cards > Add New Card Holder

- Online Banking Settings > Related Parties sub- tab

Online Banking Enterprise™:

- Online Banking Enterprise™ Registrations

- My Bank Accounts, Payments and Forex Tab > PayPal

- My Bank Account > Account Settings > Cards > Add New Card Holder

- Profile Tab > Related Parties sub- tab

- Profile Tab > Account Relationship sub-tab > CUAC

Available to:

Online Banking and Online Banking Enterprise™:

- South Africa: FNB and RMB Private Bank

|

|

| |

| Back to index |

| |

| 2.4 Frontend Framework (New) |

| |

|

We have made small architectural changes including Font, Resolution and Scaling to our framework across all our screens to improve on the overall design of the screens to further enhance our client experiences on Online Banking and Online Banking Enterprise™. |

| |

This is for:

This applies to all touch points on any device across Online Banking and Online Banking Enterprise™.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Online Banking and Online Banking Enterprise™:

- All touch points on any device across Online Banking and Online Banking Enterprise™.

Available to:

Online Banking:

- South Africa: FNB, RMB Private Bank and Discovery

- African Subs: Botswana, Lesotho, Namibia, Swaziland, Tanzania and Zambia

- FirstRand Bank: India

- Joint Ventures: Clicks and kulula

Online Banking Enterprise™:

- South Africa: FNB, RMB and RAS

- African Subs: Botswana, Lesotho, Namibia, Swaziland, Tanzania and Zambia

- FirstRand Bank: India

|

|

| |

| Back to index |

| |

| 2.5 IE8 Exit (Enhancement) |

| |

|

Last month we implemented an IE8 Exit Notification via Banners and Campaign pages on the FNB and FRB Homepage and updated our ‘Software Updates’ page as part of our planned phased approach of discontinuing our support of Internet Explorer 8.

As from 15th of May 2014, these Notifications will be extended to all clients on all our supported websites including FNB, RMB Private Bank, FirstRand Bank, all of the African Subsidiaries, Discovery as well as our Joint Venture partners: Clicks and kulula.

In addition to this banner Notification, we will also be displaying a pop up message as soon as a client attempts to login onto Online Banking or Online Banking Enterprise™ from an IE 8 Browser which will inform them that their browser version is not supported.

The pop up message box will allow the client to select an "Upgrade Now" button. Once the client has upgraded their browser version, they will no longer see this message when logging onto Online Banking or Online Banking Enterprise™.

Further IE 8 Exit Notifications will also be displayed once the client logs into their Online banking Enterprise™ profile. |

| |

This is for:

Online Banking and Online Banking Enterprise™:

These Notifications will be displayed to all Online Banking and Online Banking Enterprise™ clients.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

Online Banking and Online Banking Enterprise™:

- Home Page

- On Login

- News Tab

Available to:

Online Banking and Online Banking Enterprise™:

- South Africa: FNB, RMB Private Bank and Discovery

- African Subsidiaries: Namibia, Botswana, Lesotho, Swaziland, Zambia and Tanzania

- First Rand Bank: India

- Joint Ventures: Clicks and kulula

|

|

| |

| Back to index |

| |

| |

|

| |

| 3.1 SSA Wealth (New) |

| |

We currently provide a wide range of product and services to all new and existing clients via our online SSA platform. It is a quick and simple way for clients to take up new Accounts and is growing in popularity due to the convenience of applying for these from anywhere at any time.

With these growing trends, we are now implementing SSA on our RMB Private Bank website.

This means that new and/or existing RMB Private Bank clients can now apply to open RMB Private Bank Cheque Accounts, RMB Private Bank Credit Cards as well as other types of Accounts by completing a real time online application via the RMB Private Bank SSA platform. |

|

| |

RMB Private Bank clients will be able to perform real time applications for the following Accounts online via the Single Sales Application:

- RMB Private Bank Cheque Account with Overdraft (DDA 5A)

- FNB Cheque Account upgrades with new Overdraft/ Overdraft limit increase (DDA 5A) on RMB PB

- RMB Private Bank Credit Card (4790 2668)

- Linked Petro card (8888 8863) as a value add

|

| |

RMB Private Bank clients will be able to complete an online application form for the following Accounts via the RMB

Private Bank SSA platform. Once the application has been completed, it will be submitted to the relevant fulfilment centre who will then process the request.

- Money Market Transactor – DDA 2K

- Call account – DDA2L

- 7 Day Interest Plus – TOA 97

- 32 Day Interest Plus – TOA 4E

- MyNotice – TOA 95

- Flexi Fixed – TOA 4F

- Fixed Deposit – TOA 98

- RMB Private Bank Home Loan - MLS WHL

- RMB Private Bank Single Facility - DDA 4A

|

| |

This is for:

This functionality will be available to all consumer clients applying for one of the available Account offerings via the SSA platform.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- www.rmbprivatebank.com > Apply Now

Available to:

- South Africa: RMB Private Bank

|

|

| |

| |

| RMB Private Bank clients will now be able to open accounts online via the RMB Private Bank Online Sales platform: |

|

|

| |

| |

| |

| Back to index |

| |

| 3.2 DDA 93 - Rationalisation (Enhancement) |

| |

Due to the amalgamation of Smart Transactional Banking and the Core Business Banking, we will be discontinuing the Smart Cheque Account and will be offering clients the Gold Cheque account in its place.

We have made the following amendments to the Gold Cheque account to ensure that new account applications meets all the requirements for the market segment:

- We need to amend the qualifying criteria

- Remove the Fee Saver pricing option

- Remove the Mobile Pricing Option

|

|

| |

This is for:

This functionality is available to all consumer clients applying for a new FNB Cheque Account.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- Do it now> For me> Bank Accounts> FNB Cheque Account

Available to:

|

|

| |

| Back to index |

| |

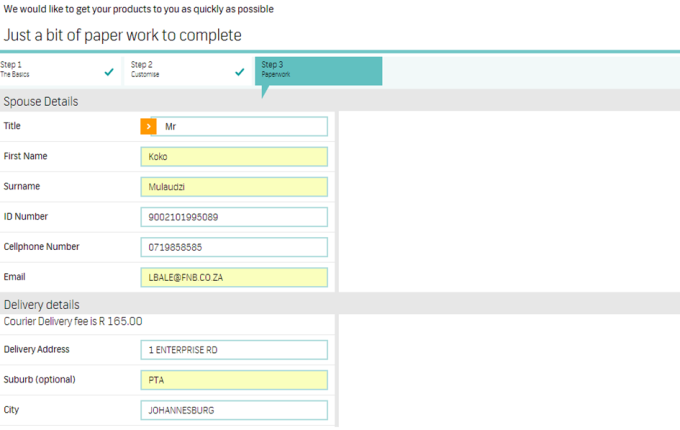

| 3.3 Spousal Consent (Enhancement) |

| |

|

We have made an amendment to one of our existing business functions to automatically pass on spouse details captured on the SSA platform from clients married in COP when applying for any credit related product such as Cheque, Credit Card and Revolving Loans to our application database.

This amendment will not just improve our internal processes and efficiencies but it will also have a positive impact on the service experience for our clients as we will have all the necessary information on hand to fulfil their Online credit application. |

| |

This is for:

The enhancement to the internal processes will only apply to applications made for credit related products by individuals married in COP.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- www.fnb.co.za > Apply Now

Available to:

|

|

| |

| |

| |

| The spouse details captured on the SSA platform for clients married in COP, will be passed onto our application databases and will be available to the relevant fulfilment areas: |

| |

|

| |

| |

| |

| Back to index |

| |

| 3.4 FATCA (Enhancement) |

| |

|

In order for us to cater for the FATCA compliance requirement, a new field has been added to our processes to correctly identify US born citizens (for individuals) and US established businesses.

The following changes have been made to our SSA Platform:

- Created a 'Country of birth' field for Individuals and' Country of Establishment' field for Businesses who are applying for new applications in South Africa, including our partners Clicks and kulula.

- Created a 'Country of birth' field for Swaziland and Zambia product applications and included a new business rule to block these African Subsidiaries to setup profiles for any US born individual and/or US established Business.

|

| |

This is for:

The new fields will be displayed on all new applications made via our SSA Platform.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- www.fnb.co.za > Apply Now

Available to:

|

|

| |

| Back to index |

| |

| |

|

| |

| 4.1 Home Loan Bond Calculator (Enhancement) |

| |

|

The online Home Loan Bond calculators provide a convenient way for clients to perform quick calculations and insights with regards to what they qualify for and how much they can save. Currently, the client has to toggle between different calculators to calculate the following:

- The maximum bond they qualify for

- How much interest and term saved by paying a lump sum amount

- How much interest and term saved by paying additional monthly repayments

- The repayment amount based on the selected interest rate, term and loan amount requested

- The loan term based on the selected interest rate, repayment and loan amount requested

We have redesigned and combined the various calculators into one calculator, the “Home Loan Bond Calculator”. This new improved Home Loan Bond Calculator will provide our clients with a summary view of calculations results calculated in a graphical format.

These graphs aim to assist our clients in better understanding the various aspects with regards to their home loans and to provide them with ways in which they can service their loan quicker. |

| |

This is for:

This functionality will be available to all clients using the calculators via our website.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- www.fnb.co.za > calculators > bond calculator

Available to:

|

|

| |

| Back to index |

| |

| |

|

| |

| 5.1 SDK Upgrade for Paypal (Enhancement) |

| |

|

Paypal has made technical upgrades to their system and due to these system upgrades we were required to make some technical upgrades to our back end systems(updated http 1 to http1.1 and upgrade of SDK tool kit) which interfaces with PayPal to enables us to offer the PayPal functionality to our clients via Online Banking. |

| |

This is for:

There is no changes to functionality, the changes only affect our backend systems which integrates with PayPal.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- Backend changes to our internal systems integrating with PayPal

Available to:

|

|

| |

| Back to index |

| |

| 5.2 Batch Archiving (Enhancement) |

| |

We are continuously assessing the risks associated to people, systems and processes as well as the most appropriate ways to mitigate the identified risk areas. In one of our recent risk assessments ,we identified an area of high concern relating to the dependency of having a single RPG developer resource to perform changes on RPG code, the programming language used for our Batch Archiving process.

In an effort to minimise these risk concerns, we have rewritten the Batch Archiving process in Java. Java is a computer programming language which was specifically designed to have far less implementation dependencies. |

| |

|

This is for:

There is no changes to functionality, the changes only affect our backend processes and mitigates the risk and impact of losing RPG developer resource.

Benefiting Segments:

- Consumer Segment

- Business Segment

- Premium Segment

|

Find it here:

- Backend changes to our internal Batch Archiving Process

Available to:

- South Africa: FNB and RMB

- African Subsidiaries: Namibia, Botswana, Lesotho, Swaziland, Zambia and Tanzania

- First Rand Bank: India

|

|

| |

| Back to index |

| |

| 5.3 Product Rule Changes (Enhancement) |

| |

|

In our continuing efforts to increase product, service and value-add take up across existing Product Houses within FNB, a number of Product and Card Rule changes are being implemented.

|

| |

| |

| Product Rule changes for South Africa: |

| |

1. Updating the descriptions for the following VBS accounts: |

| |

| Product Description |

Product Code |

| Youth Account |

DDA14 |

| Student Account |

DDA86 |

|

| |

2. Updating the Access Allowed Rules to block acccess to individual profile functionality |

| |

| Product Description |

Product Code |

| Office Account |

DDA15 |

|

| |

| Product Rule Changes for India: |

| |

| 1. Adding a new India Rewards Card Accounts: |

| |

| Product Description |

Product Code |

| MasterCard Wealth Chip Card |

BOB516609 |

| MasterCard Gold Chip Card |

BOB529745 |

| MasterCard Business Chip Card |

BOB522376 |

|

| |

| |

| |

© Copyright 2014, First National Bank - a division of FirstRand Bank Limited. An Authorised Financial Services and Credit Provider (NCRCP20).

FNB will never ask you to login to online banking via a link in an email.

|